«`html

Gold Prices Continue to Fall Amidst US-China Trade Agreement Progress

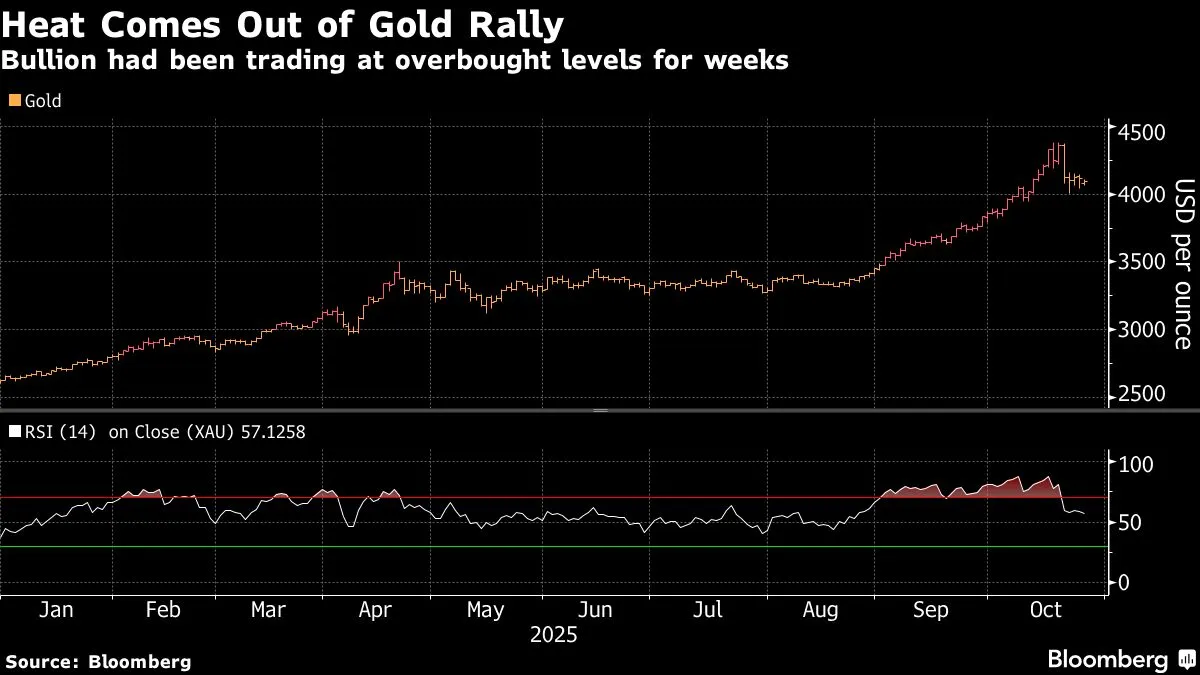

Gold prices have experienced a decline, marking their first weekly decrease since mid-August. This drop comes as the United States and China move closer to finalizing a trade agreement, which has diminished the demand for safe-haven assets like gold. Investors are also observing indications that the recent surge in precious metal prices may have been excessive and unsustainable.

The ongoing trade discussions between the two economic giants have sparked optimism in the markets, leading many investors to shift their focus away from gold, traditionally viewed as a safe investment during times of uncertainty. As the prospect of a trade deal becomes more tangible, the appeal of gold as a protective asset is waning.

Furthermore, analysts suggest that the rapid increase in gold prices in recent months may have led to an overextension, prompting a necessary correction in the market. As traders reassess their positions, the combination of trade optimism and potential corrections in gold pricing is likely to influence market dynamics in the short term.

As the situation develops, market participants will be keenly watching for further updates on the trade negotiations, as these factors will play a significant role in determining gold’s trajectory in the coming weeks.

«`

Source: Original