«`html

BlackRock Supports South African Bonds in Light of US Debt Worries

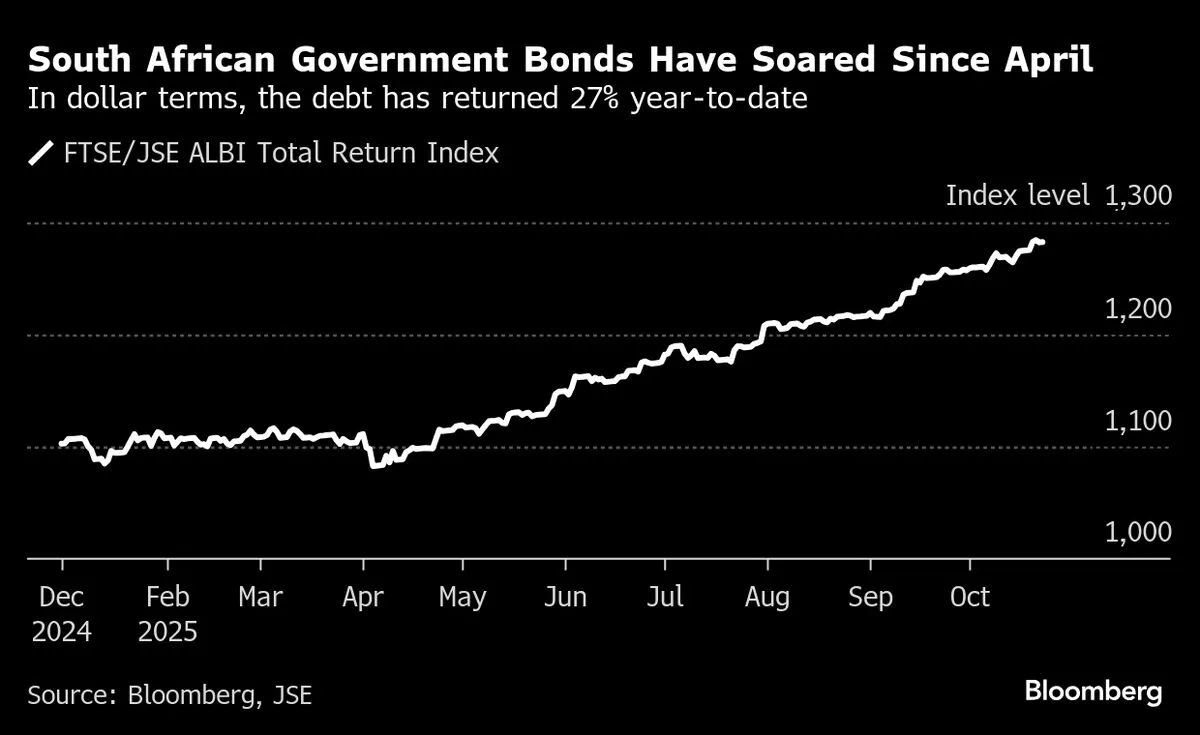

As concerns grow over the stability of the US dollar and escalating government debt, South African local-currency government bonds are emerging as a preferred investment option. This trend is highlighted by insights from BlackRock Inc., a leading global investment management firm.

Investors are increasingly seeking alternatives to traditional US Treasuries, which have faced scrutiny due to rising interest rates and fiscal challenges in the United States. BlackRock’s analysis suggests that South African bonds offer a compelling opportunity for those looking to diversify their portfolios while navigating the current economic climate.

With the South African economy showing resilience and potential for growth, these bonds are gaining attention as a viable investment strategy. The combination of attractive yields and the possibility of currency appreciation makes South African government bonds an appealing choice for investors seeking stability amid uncertainty in the US financial landscape.

As the dynamics of global finance continue to evolve, BlackRock’s endorsement of South African bonds underscores the importance of considering diverse investment avenues. This shift reflects a broader trend in the investment community, prioritizing international assets to mitigate risk and enhance returns.

In conclusion, as worries about US debt persist, South African local-currency government bonds are positioned to attract more interest from investors, offering a strategic alternative in an increasingly complex financial environment.

«`

Source: Original