«`html

ECB to Maintain Interest Rates at 2% for the Next Two Years, Survey Indicates

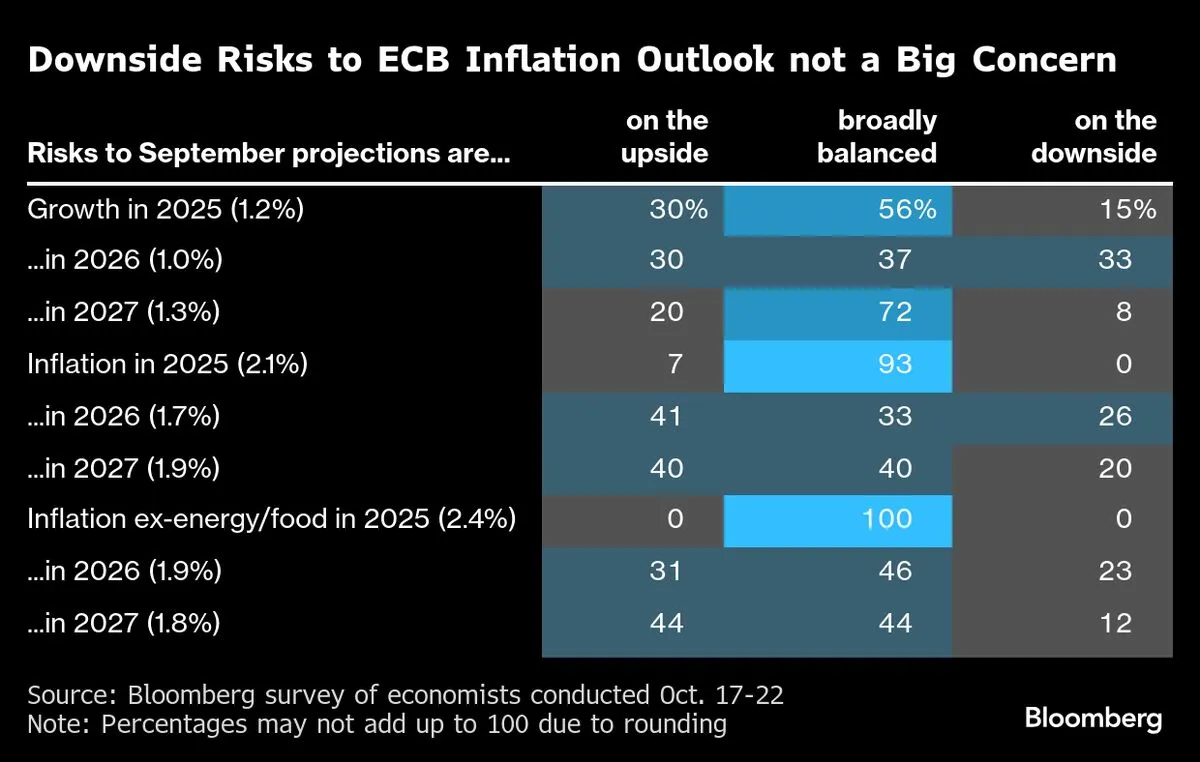

The European Central Bank (ECB) is set to keep borrowing costs within the euro zone at a steady rate of 2% until 2027, as revealed by a recent Bloomberg survey of economists. This decision reflects the central bank’s ongoing strategy to navigate economic challenges while ensuring stability in the financial markets.

Economists participating in the survey anticipate that the ECB will prioritize maintaining current interest rates in light of various economic indicators and inflation trends. This approach aims to provide clarity and predictability for businesses and consumers alike, fostering a conducive environment for economic growth.

As the ECB continues to monitor inflation and economic performance across member states, the decision to hold interest rates steady is seen as a proactive measure to support the euro zone’s recovery trajectory. By maintaining these rates, the central bank hopes to strike a balance between encouraging investment and managing inflationary pressures.

Market analysts suggest that this policy will have significant implications for borrowing costs and financial planning in the region. Investors and businesses are closely watching the ECB’s moves as they prepare for the next phases of economic development.

In conclusion, the ECB’s commitment to holding interest rates at 2% for the next two years marks a critical step in its monetary policy strategy, aiming to bolster economic stability in the euro zone through 2027.

«`

Source: Original