Indonesian Bonds Face Pressure from Foreign Fund Withdrawals Amid Policy Concerns

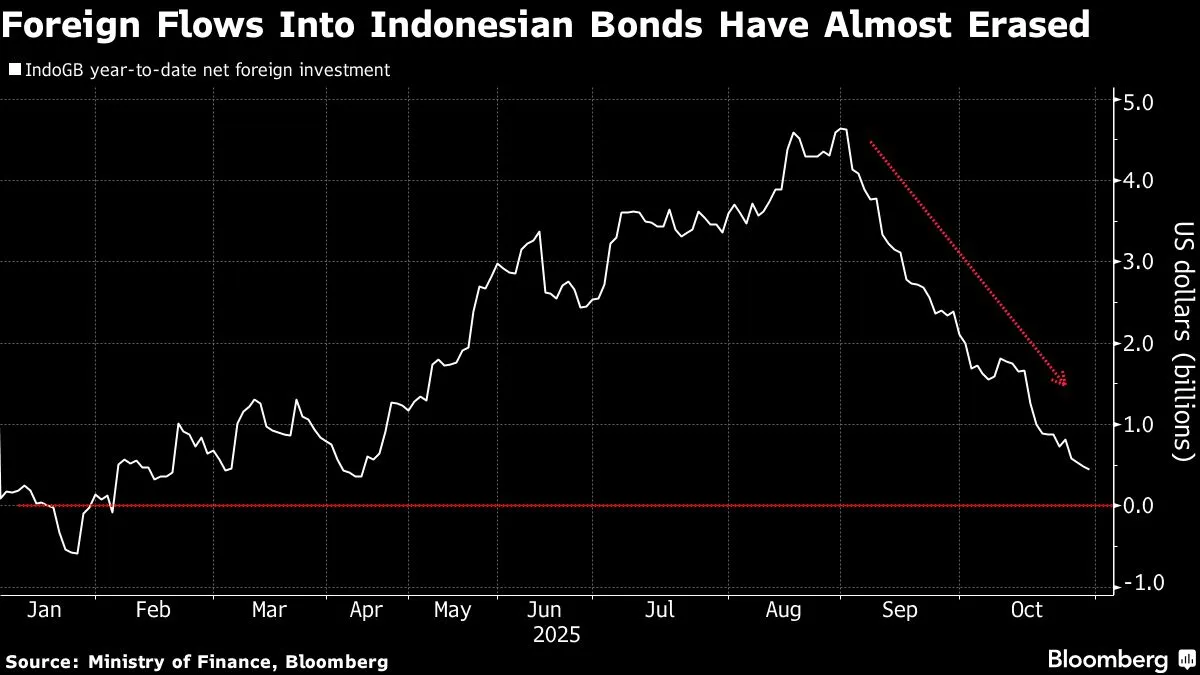

In recent developments, foreign investors have continued to divest from Indonesian government bonds, marking a significant trend observed last month. This trend highlights growing apprehensions surrounding the government’s proposed initiatives to boost spending and raise the deficit ceiling.

The ongoing sell-off of Indonesian bonds reflects a broader unease among international investors regarding the sustainability of the country’s fiscal policies. As the government contemplates increasing its spending to stimulate economic growth, concerns about the potential impact on the budget deficit have intensified.

Analysts suggest that the proposed changes could lead to a deterioration in Indonesia’s fiscal health, prompting foreign investors to reevaluate their positions. The combination of rising expenditures and a higher deficit limit raises questions about the government’s commitment to maintaining fiscal discipline, which is crucial for attracting foreign capital.

As a result, the Indonesian bond market has experienced volatility, with yields fluctuating in response to these developments. Investors are closely monitoring the situation, as any significant shifts in policy could further influence their investment decisions.

In conclusion, the recent outflows from Indonesian bonds serve as a stark reminder of the delicate balance between government spending and fiscal responsibility. With foreign investors on edge, the Indonesian government faces the challenge of reassuring the market while pursuing its economic agenda.

Source: Original