«`html

India’s Central Bank Boosts Domestic Gold Reserves Amid Global Tensions

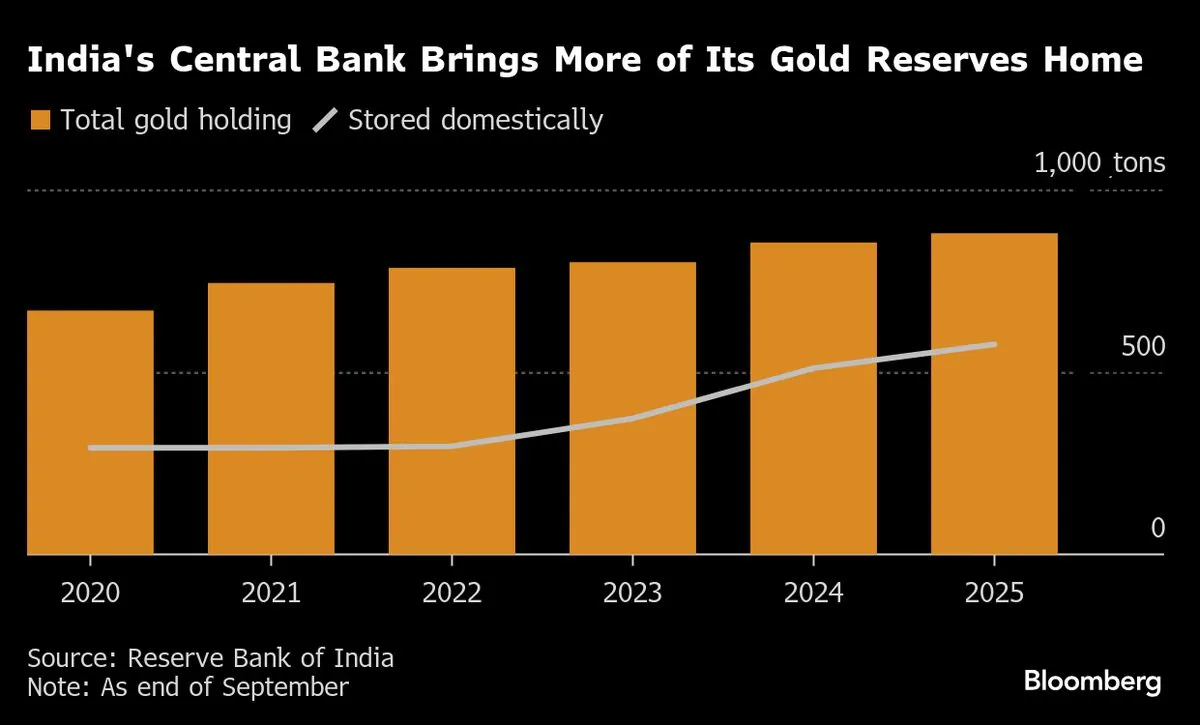

The Reserve Bank of India (RBI) has significantly increased its domestic gold reserves, now holding over 65% of its total gold stock within the country. This marks a substantial rise from just four years ago when the figure was nearly half that amount. The acceleration in repatriating gold comes in response to geopolitical developments, particularly the freezing of Russian reserves by Western nations following Russia’s invasion of Ukraine.

This strategic move is aimed at enhancing India’s financial security and reducing reliance on foreign-held assets. By bringing more gold back to Indian shores, the RBI is not only safeguarding its reserves but also bolstering national confidence in the face of international uncertainties.

The RBI’s decision reflects a broader trend among countries reassessing their gold holdings in light of global economic shifts. As nations navigate complex geopolitical landscapes, having substantial domestic reserves of gold is becoming increasingly important for maintaining financial stability.

As India continues to repatriate its gold, it solidifies its position as one of the world’s largest gold holders, emphasizing the importance of precious metals in central banking strategies. This initiative is expected to strengthen India’s economic framework and provide a buffer against external financial pressures.

«`

Source: Original