«`html

Ongoing Money-Market Strain as Fed Prepares for Portfolio Transition

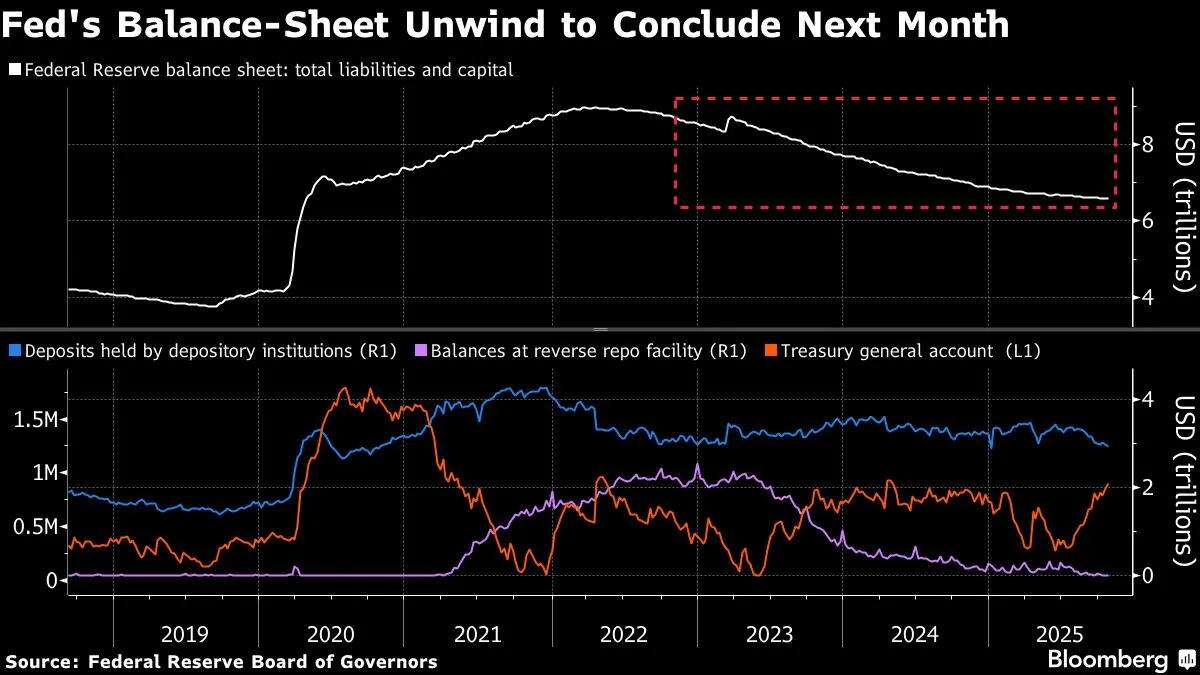

As we approach November, tensions in the money markets continue to endure, driven by persistently elevated funding costs. This situation is creating increasing pressure on the Federal Reserve to enhance liquidity measures, even as it prepares to halt the reduction of its portfolio in the coming month, according to insights from Wall Street analysts.

The current environment reflects significant challenges for financial institutions, as high funding costs can hinder their ability to manage liquidity effectively. Analysts suggest that unless these pressures are addressed, the stability of the money markets may be at risk, potentially impacting broader economic conditions.

With the Federal Reserve’s anticipated shift in policy, market participants are closely monitoring how these changes will influence liquidity dynamics. The Fed’s decision to stop shrinking its portfolio is expected to play a crucial role in alleviating some of the financial stress observed in recent weeks.

As we move forward, stakeholders in the financial sector are advised to stay informed about the evolving landscape of money markets and the Federal Reserve’s strategic decisions, as these factors will undoubtedly shape the economic outlook in the months ahead.

«`

Source: Original