«`html

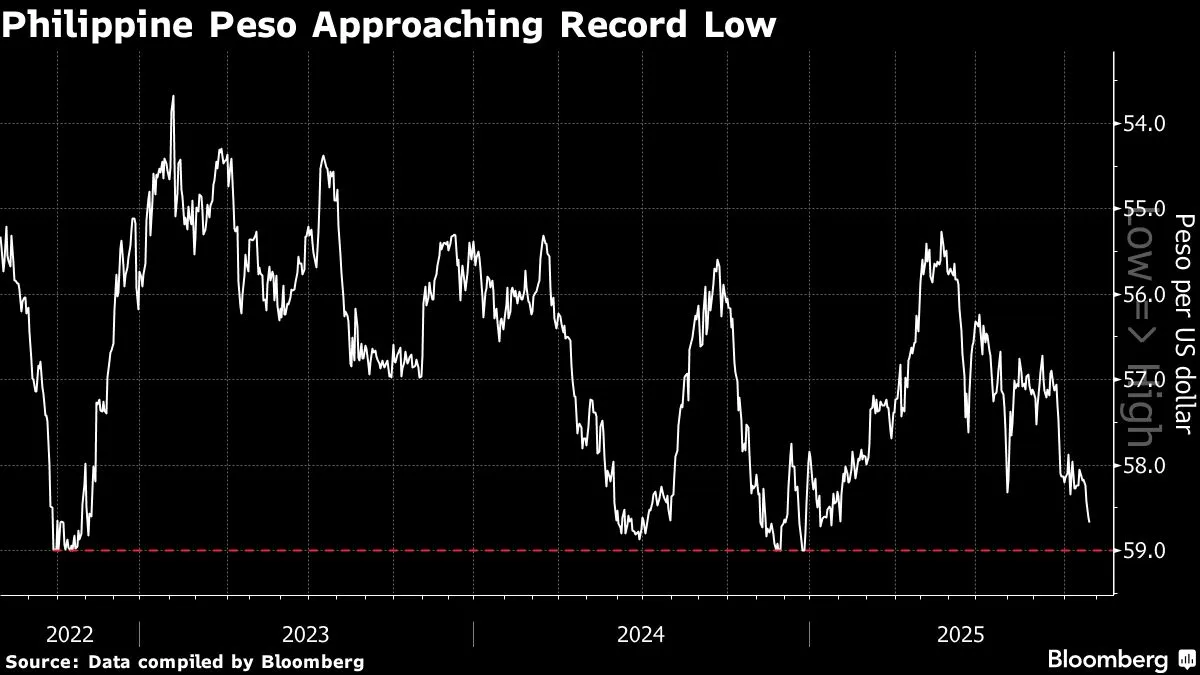

Philippine Peso Hits All-Time Low Amid Rate Cut Speculation and Capital Outflows

The Philippine peso has recently plunged to a historic low, driven by growing concerns over potential interest rate cuts and significant capital outflows from the country. This decline reflects broader economic uncertainties and shifts in investor sentiment regarding the Philippines’ financial landscape.

Market analysts are closely monitoring the implications of these developments, as the possibility of reduced interest rates could influence the peso’s performance further. Investors often react to changes in monetary policy, leading to fluctuations in currency value. The expectation of lower interest rates typically diminishes returns on investments denominated in that currency, prompting capital flight.

In addition to the anticipated monetary adjustments, outflows from the stock market have accelerated, contributing to the peso’s depreciation. As foreign investors withdraw funds, the demand for the peso decreases, thereby exacerbating its decline.

Economists suggest that the Philippine government and central bank will need to implement strategic measures to stabilize the currency and restore investor confidence. This situation highlights the importance of monitoring both domestic economic indicators and global market trends as they play a crucial role in shaping the future of the Philippine peso.

«`

Source: Original