«`html

Recent Credit Market Collapses Raise Concerns Over Maturity Wall

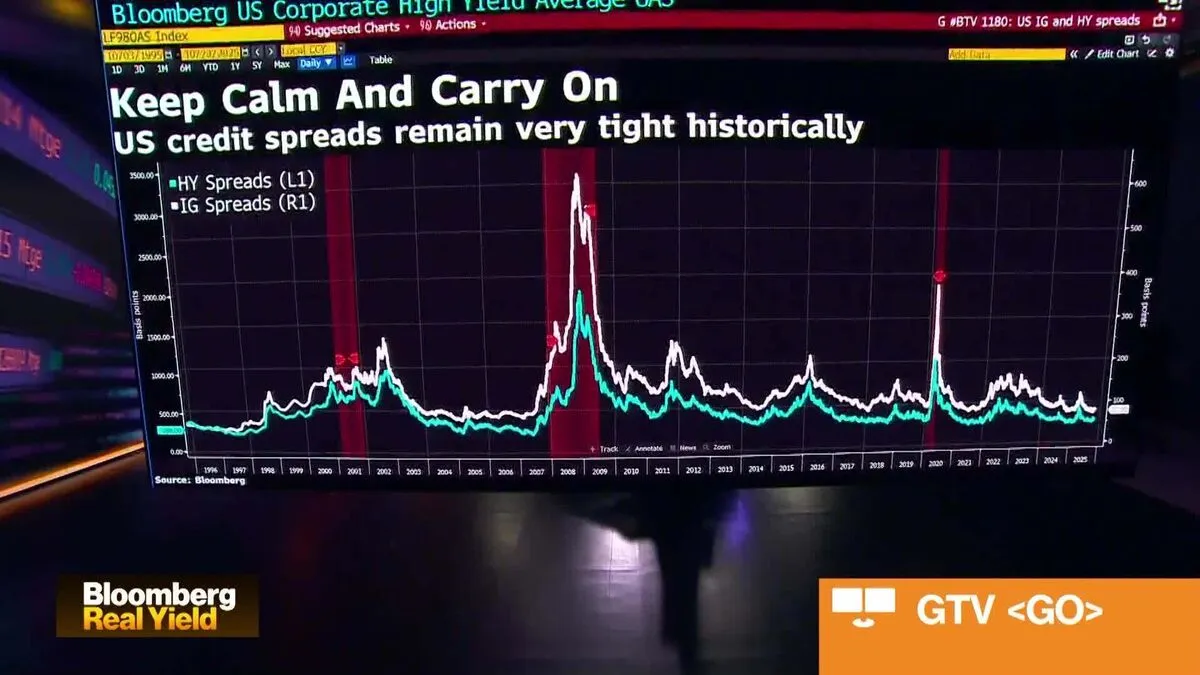

In the aftermath of several notable collapses within the credit market, leaders from both banking and private credit sectors have engaged in a blame game, each asserting their superior resilience in the face of potential economic downturns. This ongoing tension highlights the fragility of the current credit landscape.

Meghan Robson, the head of US credit strategy at BNP Paribas, alongside Michael Best, a high-yield portfolio manager at Barings, recently shared their insights on the evolving credit market dynamics during an interview with Scarlet Fu on «Bloomberg Real Yield.» Their discussion shed light on the growing apprehensions surrounding credit stability and the looming maturity wall that could impact market players significantly.

As the credit market navigates these turbulent waters, understanding the implications of recent collapses and the strategies employed by industry leaders will be vital for investors and stakeholders alike. The conversation underscores the need for vigilance and adaptability in an unpredictable financial environment.

For more in-depth analysis and expert opinions, tune in to «Bloomberg Real Yield» where market trends and credit strategies are explored in detail.

«`

Source: Original