«`html

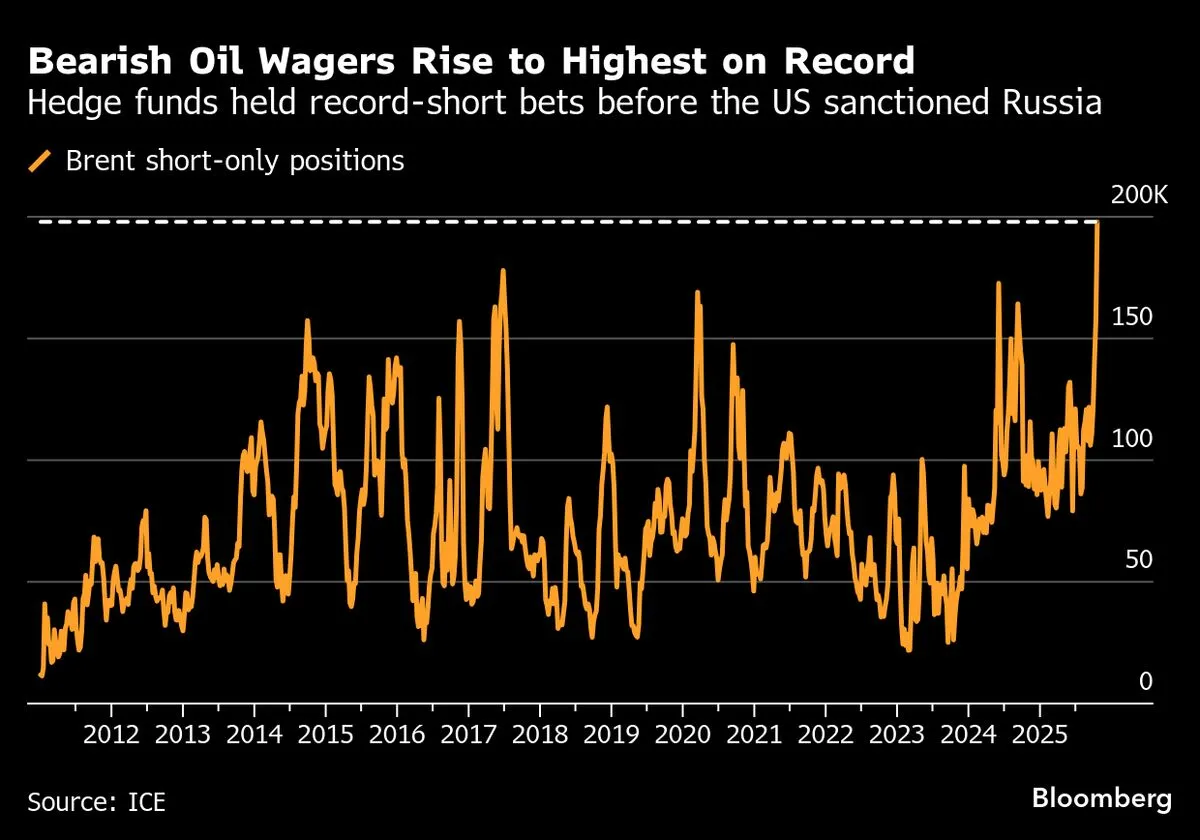

Hedge Funds Overlook Sanctions-Driven Oil Surge Amidst Record Short Positions

In a striking turn of events, hedge funds with historically high short positions on Brent crude oil have found themselves on the sidelines as oil prices surged this week. This unexpected rally has been largely attributed to geopolitical tensions and sanctions that have disrupted oil supplies, creating significant volatility in the market.

As Brent crude oil prices climbed, hedge funds betting against the market faced substantial losses. The increase in oil prices was propelled by a combination of factors, including tightening supply chains and heightened concerns over energy security, which have intensified investors’ focus on crude oil as a critical asset.

Data indicates that these hedge funds have maintained their short positions, betting that prices would decline. However, their strategy has backfired as the market has reacted to ongoing sanctions that have limited the availability of oil from key producing nations.

The current market dynamics serve as a reminder of the risks involved in short selling, particularly in a climate where geopolitical factors can swiftly alter supply and demand fundamentals. As the oil rally continues, hedge funds may need to reassess their strategies in light of the evolving landscape.

Analysts predict that this rally may persist if sanctions remain in place and global demand continues to rise, potentially leading to further challenges for those holding short positions in the oil market.

«`

Source: Original