«`html

Dutch Pension Reform Sparks Hedge Fund Interest in German Bond Mispricings

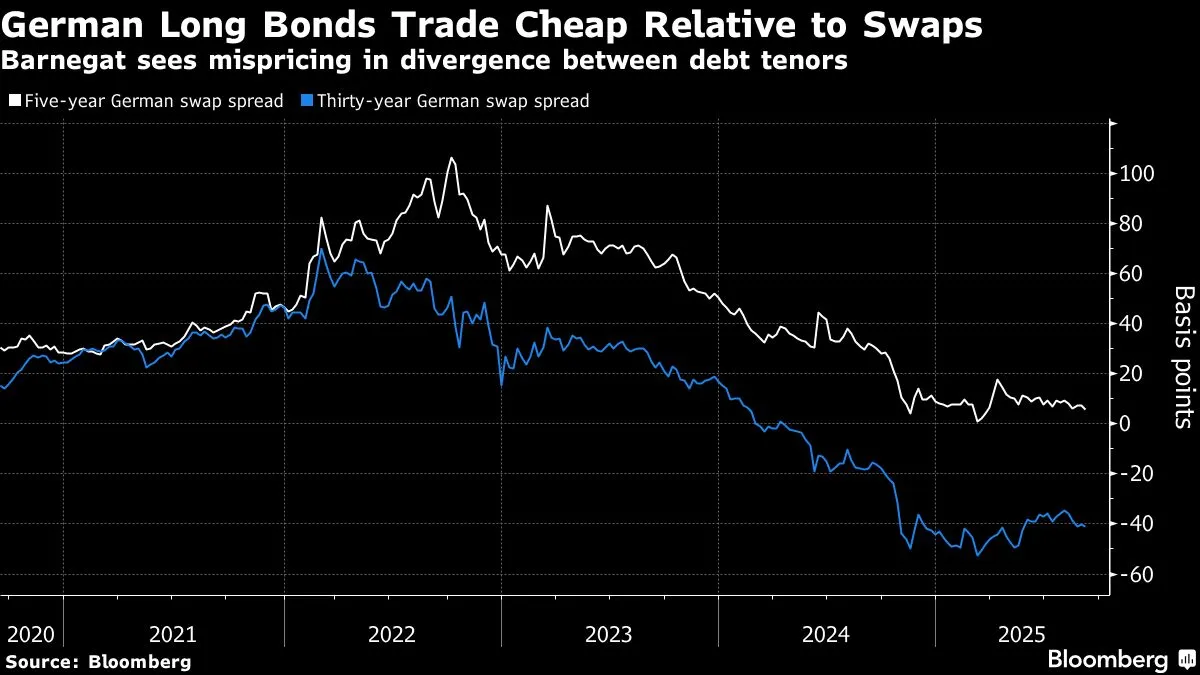

A significant overhaul of the pension system in the Netherlands is creating opportunities for hedge funds, particularly in the realm of mispriced German bonds. This shift in the Dutch pension landscape has caught the attention of a leading hedge fund, which aims to capitalize on these discrepancies in the bond market.

The recent reforms in the Netherlands are designed to modernize the pension framework, transitioning from a defined benefit model to a more flexible system. This change is expected to influence investment strategies, leading to increased volatility and mispricing in various asset classes, including German government bonds.

The hedge fund’s strategy involves identifying and exploiting these mispricings, as the market adjusts to the new dynamics introduced by the Dutch pension reforms. By leveraging their expertise in bond markets, the fund is positioning itself to benefit from potential price corrections as investors reassess their portfolios in light of the evolving pension landscape.

As the Dutch pension overhaul continues to unfold, market participants will be closely monitoring its impact on the broader financial markets, particularly in relation to German bonds. This development highlights the interconnectedness of global financial systems and the opportunities that arise from significant policy changes.

«`

Source: Original